PART I of this article on e-commerce dealt with the history of the emergence of e-commerce and its growing importance. PART 2 looks at the best approach to maximize your share, revenue and profits.

After the ‘.com’ bubble burst over 10 years ago, there was relatively slow growth in e-commerce as companies consolidated and reconsidered their positions. In the last two years, particularly however, there has been a massive resurgence and forecasts are for a massive growth of e-commerce globally and across all product fields including ‘fresh’. This growth has been fuelled by faster and more secure technology, ease of access (m-commerce), more customer friendly user interfaces, competitive pricing, faster delivery and wider choice.

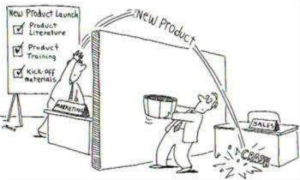

Many companies now no longer regard e-commerce as an ‘add on’ and incorporate e-commerce into an ‘omni channel’ strategy to maximize sales opportunities. In addition, many have completely restructured their organisations internally to address the importance of D2C. There are still companies, however, including global multinationals, who still have not sufficiently addressed its rapid emergence.

Part II discusses where a company might be in the e-commerce development life cycle and suggests what next steps need to be taken to turn ‘Clicks to Sales’

One possible methodology is to divide into three specific levels of e-commerce development:

- Level 1 Development (EC1): companies who recognise the opportunity but have taken no steps to consider e-commerce.

- Level 2 Development (EC2): companies who have an e-commerce site operated from within or have their products on multiple third party sites, probably offer physical delivery only and do not have the site integrated into either their channel strategy or their whole company ethos and philosophy. Site ‘efficiency’ and profitability is not measured, consumer profiles are not compared with retail buyers and SKUs are the same as those in retail traditional channels and consumer feedback is not monitored or acted upon.

- Level 3 Development (EC3): companies for whom e-commerce is already part of the internal channel strategy, (indeed e-commerce may have its own channel strategy), have an established company site or regularly monitor performance against competitors (not just Amazon) on third party sites, profitability is discussed at board level and there is a programme to continually upgrade via for example, HTML5 and ensure multi format access for smart phones, tablets as well as laptops and home PCs. SEO and MEO is de rigeur and specialists are employed to keep the internal site that way and advise retail partners.

Consider the following real global examples.

Company A, in 2011, a major German homeopathic company with well established brands was selling into retail stores across Germany. It was losing share, both to Amazon and specialist German and other EU e-commerce sites selling health foods offering the same generic product at a cheaper price. These sites also had free next day delivery to Germany. Company ‘A’ was an ‘EC1 level’ company. They were advised by one of their non-executive directors on their board to hire specialist e-commerce consultants to:

- Design and build a ‘front end’, to map out the range strategy for the new e-store.

- Ensure measured SEO was in place.

- Sub-contracted the setting up of multiple payment systems to a specialist.

- Established a north and south fulfilment system for the whole of GSA, plus guaranteed one day delivery everywhere in Germany.

- E-store prices were reviewed, taking into account the increased margin generated by selling B to C, in store prices were revised to reflect the changes and new SKUs were developed specifically for the e-store.

- Company A’s own brands were even placed on Amazon and the competitive e-commerce sites

Within six months, their share of market has been restored and additionally, sales in Bavaria, which had few retail outlets jumped 32% year on year.

Company ‘B’ was an ‘EC2 level’ multinational Australian retail chain selling video games with a ‘state of the art’ e-store offering B2C physical delivery on day of launch, special editions, multiple payment platforms, a ‘loyalty programme’ and had reduced the number of clicks to existing registered members to a maximum of three except where the credit card needed an additional check. Company ‘B’ prospered, gained market share, integrated their strategy between retail and e-store and even competed with lower priced imports.

Company ‘C’, an Australian competitor, however, was only a ‘Level 1‘ company but retailed not only video games but Blu Ray and DVDs, digital cameras, PCs and laptops, mobile phones, accessories and books and ‘cheat guides’ about the branded products.

Company ‘C’ hired local e-commerce Melbourne consultants and converted themselves to beyond ‘Level 2’ in seven months. The first move was to build a consumer friendly in-house e-commerce site that offered the choice of digital downloads or physical delivery on PC games and digital tokens for Xbox Live and PlayStation store games. This resulted in not only physical prices becoming more competitive, as the margin on digital increased by 38%, but enabled instant delivery and pre ordering and downloading. Secondly, branded camera goods were ranged on the site. Meta data from the manufacture was included in multiple languages and demonstrated on the site, with tips and suggestions for interested buyers. Delivery was offered to the home or by in store pick up. Six other major enhancements were built in including instructions for some products in Mandarin where it was identified that > 20% of the mobile phone purchasers actually had Chinese as their first language.

Company ‘C’ now not only have the largest market share in video games but have increased turnover in Australia (retail and e-commerce combined) by 28% and profitability (direct operating income (DOI) a % of gross sales) by 16%.

Company ‘D’, a major US blue chip global consumer products company were already an ‘EC3’ level’ Company. They had both internal e-commerce sites and monitored and advised third parties on the optimisation of selling the company’s products on the third party sites.

They had foreseen very quickly the emergence of e-commerce but additionally, the importance of ‘digitisation’ of the all the divisions internationally of the company and the value of a direct relationship with the end user.

No stone was been left unturned in engaging with consumers on their comments received on both their own sites and third party vendor sites. The objective was to maximise the number of consumers clicking and buying, not just clicking. Even ‘Bayesian’ analysis was used to monitor the ‘consumer pulse’ and iPads adopted in production plants to follow the predicted path of the product to the consumer. Not only to the consumer in the USA but even as far as the Philippines and Japan.

The ‘EC3’ Level 3 however needs to continually upgraded and there are now specialised e-commerce consultants on hand to guide them to get to the ultimate goal of tracking profitability through both the company’s own sites and the partner third party retailer sites. The most advanced, consumer friendly, fastest access technology, the continual monitoring of the clicks to purchase, the identification of the consumer groups most likely to purchase on which site, the brand most likely to sell on line compared to in store; the list is endless and still evolving.

E-commerce is now very deep and advanced, it is something that can bring instant results as in the case of the German homeopathic product company, it can enable a company to ‘leap frog’ another as in the Australian example, or can transform a multinational USA company’s philosophy.

Like a modern car, however, the fan belt cannot be changed without first connecting with the laptop, getting to ‘Level 1, 2, or 3’ requires a specialist adviser. As with the new automobile technician, the investment in his or her specialist knowledge will pay off in a very short time.

In the digital era, instantly.

Ignore e-commerce, or give it just lip service, at your peril.

So, what level does your company operate at with regards to e-commerce?

EC1? Where it is hardly recognised or has been difficult to get through corporate red tape?

EC2? Where e-commerce is an important part of your business, it is recognised corporately and has a ‘division’ working on it but still is not 100% integrated in to the fabric of the company?

EC3? Where not only e-commerce but digital marketing has changed the way the company does business, indeed the whole structure of the company and its marketing and sales philosophy.

We would be interested to hear from you, listen to your own experiences and happy to help.

Written by D Turnbull and D Reeves of The Quantic Group